One way to do so is by filing Form 8822, Change of Address.

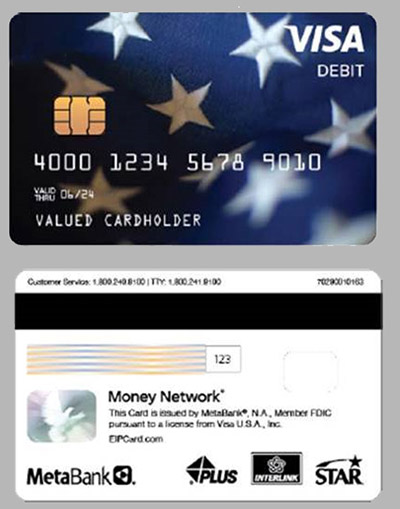

If your address changed, you may need to go through the process of changing it on file with the IRS. Some direct deposit efforts ran into a glitch since some bank accounts on file were temporary setups that were used by tax preparers as part of a tax refund process and those accounts are no longer active. "Typically, once the payment is mailed, it will take up to 14 days to receive the payment, standard mailing time," the IRS said. If an account is closed or was invalid, the bank will reject the deposit. The IRS has to mail a payment to the address it has on file for you, if the bank rejected the deposit. My payment went to a bank account that was closed. Don't share your Social Security or bank account information with those impersonating the IRS. But scammers might call pretending to be from the IRS or another agency and offer to "help" you process your Economic Impact Payment. Will the IRS call about my stimulus payment? Debit card payments come in a plain envelope from 'Money Network Cardholder Services.' "Ībout 4 million people who don't have direct deposit information on file with the IRS are expected to see their Economic Impact Payments on prepaid debit cards.The cards first began hitting mailboxes in late May. Maybe or maybe not. Now the IRS "Get My Payment" site warns at the top: "If the Get My Payment application says you’re receiving a check, your payment may come as a debit card. The IRS says online that I'm getting a check, will I? See to review the process. Transfers should post to your bank account in one to two business days. The new limit for electronic transfers to your bank account is $2,500 per transaction - up from a previously announced $1,000. Once you get that card, it's possible to transfer it to a bank account if you want. You can call 80 (select option 2 from main menu). What if I threw away a card loaded with stimulus money?įortunately, the IRS said you don't need to know the number on that card to request a replacement.

IRS STIMULUS DEBIT CARD ENVELOPE LOOK LIKE UPDATE

The IRS continues to regularly update its FAQ under "Get My Payment" to address some areas of confusion. So here are some of the latest updates from the IRS that could help many people who have still not received money or lost it. The card, of course, is not the only headache associated with the rollout of stimulus payments that began in mid-April. Many people had never heard that the IRS was sending prepaid debit cards to some the IRS made note online at IRS.gov on May 20 of the debit cards issued by MetaBank. The prepaid debit card was one of the odder, more confusing twists of the rollout of stimulus money - or Economic Impact Payments - during the coronavirus relief effort.

Normally, you would have been hit with a $7.50 fee for reissuing that card.

IRS STIMULUS DEBIT CARD ENVELOPE LOOK LIKE FREE

In an email to tax professionals Monday, the Internal Revenue Service said people who have lost or destroyed their Visa prepaid debit cards now can request a free replacement through MetaBank’s customer service department, as reported by Accounting Today.

0 kommentar(er)

0 kommentar(er)